swIDch: Waarom talloze kaarten niet genoeg zijn om betalingsfraude aan te pakken

LONDEN– (BUSINESS WIRE) – Een Britse cybersecurity-startup, swIDch, heeft een alternatieve technologie aangekondigd om de beperkingen van talloze kaarten te overwinnen door dynamische PAN’s (primair accountnummer) te gebruiken, waardoor een nieuwe beveiligingsomgeving wordt gecreëerd in het betalingsproces.

Het elimineren van nummers op betaalkaarten verhoogt de veiligheid als klanten hun kaart verliezen. Hackers kunnen echter zwakke punten uitbuiten door middel van online betalingen.

Talloze kaarten lijken een nieuwe trend in financiën te zijn, gecombineerd met een aanzienlijke groei van e-wallet-diensten. Apple’s creditcard, GrabPay in Azië en enkele Europese Fintechs zijn van plan het product met vergelijkbare voordelen te lanceren. Het doel van talloze kaarten is het verhogen van de beveiliging. Het verkleint de kans op verlies van persoonlijke informatie wanneer de kaart in verkeerde handen valt. Als het echter gaat om online betalingen, lopen de inloggegevens van klanten nog steeds het risico te worden getarget op CNP-fraude (Card Not Present). Dit komt omdat de kaartgegevens van de klant statisch zijn.

swIDch: Why Numberless Cards Are Not Enough to Tackle Payment Fraud

LONDON–(BUSINESS WIRE)– A UK cybersecurity startup, swIDch, announced an alternative technology to overcome the limitations of numberless cards by using dynamic PANs (primary account number), thereby creating a new security environment in the payment process.

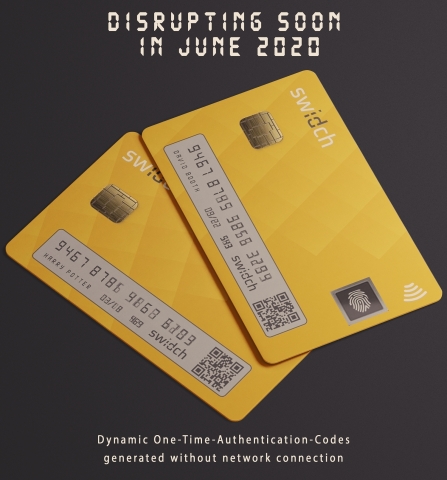

A UK cybersecurity startup, swIDch, announced an alternative technology to overcome the limitations of numberless cards by using its Dynamic Virtual PAN (primary account number) technology, thereby creating a new security environment in the payment process. This patented technology is a complete API-driven, CNP security solution that replaces static with dynamic PANs as well as eliminating access points for hackers. (Graphic: Business Wire)

Eliminating numbers on payment cards increases security if customers lose their card. However, hackers can exploit weaknesses through online payments.

Numberless cards appear to be a new trend in finance combined with a substantial growth of e-wallet services. Apple’s credit card, GrabPay in Asia and a few European Fintechs plan to launch the product with similar benefits. The purpose of numberless cards is to increase security. It reduces the risk of personal information loss when the card falls into the wrong hands. However, when it comes to online payments, customers’ credentials are still at risk of being targeted for CNP (Card Not Present) fraud. This is because the customer’s card information is static.

For online payments, customers are often required to input their card information. For those with numberless cards, they can view their card number in the issuer’s App. In this procedure, the static PANs can be exposed to hackers and the cardholders become victims of CNP fraud. Another consequence of using static PANs is BIN (Bank Identification Number) attacks letting cybercriminals know BIN numbers and systematically generate potential valid card numbers.

To prevent CNP fraud, e-wallet providers adopt tokenization technology to substitute sensitive data for mobile payment. However, only 35% of online merchants have integrated this technology, leaving the remaining vulnerable to CNP fraud.

While some banks use disposable virtual cards as a solution, the costs to maintain this service are prohibitive. What if customers can generate dynamic virtual cards without an internet connection for each online transaction reducing the cost for banks?

swIDch has introduced Dynamic Virtual PAN technology for businesses offering a numberless cards solution. This patented technology is a complete API-driven, CNP security solution that replaces static with dynamic PANs as well as eliminating access points for hackers.

swIDch is also developing a biometrically enabled ‘Digital display cards’ that shows a dynamic card number for authentication. The card has no battery and instead uses an energy harvesting system to draw power from NFC devices. The company plans to launch the new digital cards in June 2020 with the collaboration of card manufacturers.

Contacts

swIDch Ltd.

Su Hyun Luquet

+44-7951-409-765