Tudi Selects ThetaRay AI Solution to Monitor Domestic Payments in Mexico

Mexican financial mobile app to integrate AI-powered AML technology for detection of known and unknown financial crime

MONTERREY, Mexico & NEW YORK & TEL AVIV–(BUSINESS WIRE)– ThetaRay, a leading provider of AI-powered transaction monitoring technology, today announced that Tudi, enabling a digital financial community through its mobile app, has chosen ThetaRay’s cloud-based AML solution to monitor its transactions in Mexico for financial crime.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230223005040/en/

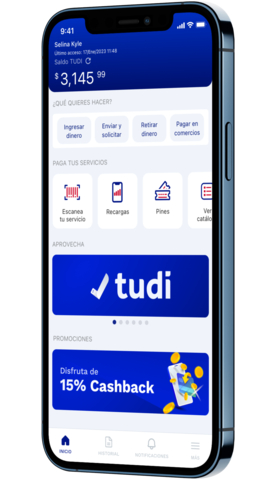

Tudi digital financial community mobile app (Photo: Business Wire)

A Stella Tech technology company, Tudi is helping the Mexican payment market move to cashless services in a one-stop application that solves the end-user transactional needs, including paying bills, money transfers, top-ups, entertainment services, and government fees. The app also promotes community brand engagement with consumers at merchant point-of-purchase.

Through the agreement, ThetaRay will provide Tudi its SONAR SaaS solution for AI-powered transaction monitoring that can detect the earliest signs of sophisticated financial crimes, including money laundering, narco-trafficking, terrorist financing, and human trafficking, including known and unknown crime patterns. This will enable Tudi to provide a compliant service under the new Mexican law that regulates fintechs (LRITF) and grow its business with a trusted and safe payment service.

“Mexican regulators are requiring non-bank payment providers to operate sophisticated AML systems that can prevent money laundering. We were searching for a proven solution that would enable us to be compliant and stay one step ahead of developing AML scenarios in the country that challenge and risk our operations,” said Andrés Adame Guajardo, VP Product at Tudi. “ThetaRay’s technology will help us realize our vision to serve the unbanked in Mexico with low-cost and convenient digital financial services. The younger generations are not deterred by technology, and digital platforms will enable them to become stronger financial players, reduce the cash-based economy, and increase economic prosperity through the use of modern financial services.”

According to the World Bank, in Mexico only 37 percent of adults in Mexico have accounts, and just 32 percent have made or received digital payments, both significantly below numbers in countries with similar levels of development.

“Tudi is a digital financial services leader that is helping promote financial inclusion by bringing innovative services to underserved economic players. With ThetaRay’s advanced and effective AI-driven AML technology these services can also be trusted by financial partners and regulators,” said Mark Gazit, CEO of ThetaRay. “The ThetaRay AI solution also makes the entire process of transaction monitoring efficient and effective, while improving customer satisfaction, reducing compliance costs, and increasing risk coverage with safe and secure payments.”

ThetaRay’s award-winning SONAR solution is based on a proprietary form of AI, artificial intelligence intuition, that replaces human bias, giving the system the power to recognize anomalies and find unknowns outside of normal behavior, including completely new typologies. It enables fintechs and banks to implement a risk-based approach to effectively identify truly suspicious activity and create a full picture of customer identities, including across complex, cross-border transaction paths. This allows the rapid discovery of both known and unknown money laundering threats.

About ThetaRay

ThetaRay’s, AI-powered SONAR transaction monitoring solution, based on “artificial intelligence intuition,” allows banks and fintechs to expand their business opportunities and grow revenues through trusted and reliable cross-border payments. The groundbreaking solution also improves customer satisfaction, reduces compliance costs, and increases risk coverage. Financial organizations that rely on highly heterogeneous and complex ecosystems benefit greatly from ThetaRay’s unmatchable low false positive and high detection rates.

To learn more about ThetaRay, please visit: https://www.thetaray.com/

View source version on businesswire.com: https://www.businesswire.com/news/home/20230223005040/en/

Contacts

Nina Gilbert, ThetaRay

Nina.gilbert@thetaray.com