Allianz Survey: High Level of Approval for Data Use in Accident Investigation

- Every second respondent is willing to make their data available for insurance services

- One in two drivers fears misuse of data

- Three-quarters demand clear deletion procedures

MUNICH–(BUSINESS WIRE)– The survey of European car drivers about vehicle data* conducted as part of this year’s Allianz Motor Day revealed a rather low level of understanding of the modern world of data in our cars. The fear of data misuse and loss of privacy is noticeable. But the survey also showed that the benefits that people can derive from their data are seen. There is great interest in using data for innovative services and accident clarification.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231017247685/en/

Every second respondent is willing to make their data available for insurance services (Credit: Allianz)

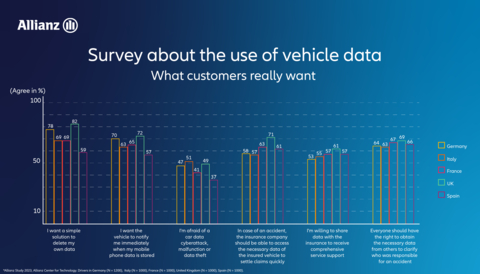

Better accident clarification, faster claims processing

With two-thirds of all respondents agreeing, approval is highest of data use for clarifying accident blame. For example, 69 percent (UK), 67 percent (France), 66 percent (Spain), 64 percent (Germany), and 63 percent (Italy) agree with the statement that every party involved should have the right to receive the data necessary for this purpose. “Our survey shows that there is a very positive view of the benefits of data recording for accident investigation,” says Jörg Kubitzki, safety researcher at the Allianz Center for Technology (AZT) and co-author of the study.

The use of data for quick accident processing by the insurance company also found high approval ratings (UK: 71 percent, France: 63 percent, Spain: 61 percent, Germany: 58 percent, Italy: 57 percent). The interest in making data available to the insurance company for improved services (e.g., automatic accident detection, roadside assistance, adapted insurance products) is 61 percent (UK), 57 percent (France, Spain), 55 percent (Italy), and 53 percent (Germany). Clarification of vehicle condition at the time of purchase and sale was agreed to by 58 to 69 percent of respondents, and improvement of road safety by 48 to 58 percent.

Protecting privacy is important

Above all, telephone usage data, destinations or locations, and routes driven are regarded as sensitive information, the unauthorized use of which is viewed critically. There is a high level of fear of hacking attacks, data theft, and data misuse by unauthorized persons. In Germany (47 percent), the UK (49 percent) and Italy (51 percent), one in two had concerns. In Spain (37 percent) and France (41 percent), respondents rated the risk slightly lower. Many of those surveyed doubted that the data in the vehicle would only be used on an occasion-related basis (France: 42 percent, Spain: 46 percent, Germany: 54 percent, UK: 55 percent, Italy: 56 percent). “The concern about data protection is more than an abstract fear of hacking attacks,” says Kubitzki. “Anyone who makes data available, for example to process claims more quickly, must be confident that the information required for this is only used for the intended purpose.”

Three-quarters of respondents demand clear deletion procedures

Drivers in all five countries would like to see better data organization in their vehicles. More than two out of three respondents expect to be informed when phone data is stored (Spain: 57 percent, Italy: 63 percent, France: 65 percent, Germany: 70 percent, UK: 72 percent) and demand simple ways to delete their data in the car (Spain: 59 percent, Italy and France: 69 percent, Germany: 78 percent, UK: 82 percent).

*Representative Allianz online survey of 5,200 drivers in 2023 in Germany (N=1,200), Italy, France, the UK, and Spain (N=1,000 each) by Allianz market research institute DrivenBy, the Allianz Center for Technology (AZT), and market research company Ipsos. All results can be found in a 35-page report in German and English, which we will be happy to send to you in electronic form.

All press materials and the recording of the entire event as well as information on the EU Data Act can be found here: https://events.techcast.cloud/en/allianz/11th-allianz-motor-day-2023-en

View source version on businesswire.com: https://www.businesswire.com/news/home/20231017247685/en/

Contacts

Allianz Versicherungs-AG

Corporate Communications

Christian Weishuber

Phone: 089.3800-18169

Mobil: 0172-8448464

E-Mail: christian.weishuber@allianz.de